The flaws of noon reporting are widely known in our industry, but the long-term commercial consequences of using this data to run a maritime shipping business are not as well understood. In this case study, we flesh out both how better data collection and analysis can benefit the economics of each voyage, and also how building a business on a stronger data foundation reaps huge returns over the course of time.

To explore this, we examine a single voyage for a single ship to uncover how flawed noon data can leave millions of dollars on the table over a vessel’s life – and how Nautilus Platform helps owner-operators optimize the commercial performance of their business with better data.

Operational inefficiencies uncovered

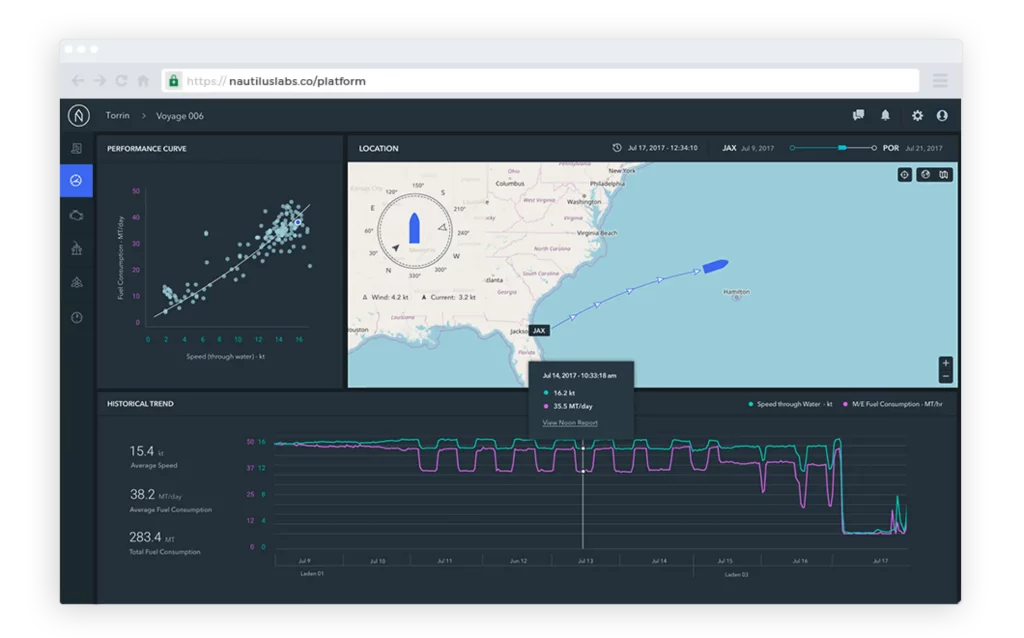

Leveraging real-time sensor data streaming into Nautilus Platform, a shoreside operations team was monitoring a trans-Pacific voyage. The operator noticed that the vessel was repeatedly traveling at a higher speed during the day than it was at night, and that this was due to the engine being run at two different RPMs depending on the time of day. While the crew reported an averaged speed of 17.0 knots on their noon reports, the vessel was actually running at 17.3 knots during the day and 15.6 knots overnight. This behavior had been recurring for just over a week.

The operator then called the captain and inquired why this vessel behavior was reflected in the autologged data. After some discussion with the crew, they determined that the speed modulation was not necessary, and that the vessel could travel consistently at the ordered speed for the remainder of the leg. This resulted in some incremental fuel savings on the remainder of the voyage and a much deeper economic benefit long-term. If the shoreside teams had relied only on the manual noon reports, neither the immediate reduction in fuel consumption nor a more precise understanding of vessel efficiency would have been possible.

Better visibility produces better results

Based on the sensor data that Nautilus Platform captured from the vessel’s fuel mass flow meters, the ship consumed a total of 330.85 MT while the speed was being varied. When the vessel was traveling 17.3 knots, it was consuming fuel at a rate of 49 MT/day. When the vessel was traveling at 15.6 knots, it was consuming fuel at a rate of 37 MT/day. After the crew adhered to the ordered speed, the vessel ran consistently at 16.0 knots and burned 42 MT/day.

If the vessel had traveled at the ordered speed for the period in question, the gross fuel consumption would have been 318.50 MT. Thus, the ship consumed 12.35 MT more than it would have consumed at the ordered speed. Assuming $350/MT of HFO, this equates to over $4,300 of extra spend on fuel alone in this one voyage. While the prospect of saving a few thousand dollars on bunkers is only so interesting, it is important to understand the long-term implications of this improved insight, because it impacts every decision our client would have made about the vessel in question.

| Rate of Consumption (MT / day) | Total Fuel Consumed (MT) | |

|---|---|---|

Period* of Oscillating Speeds | 49 (high speed) / 37 (low speed) | 330.85 |

Period* at Ordered Speed (Calculated) | 42 | 318.50 |

| Amount of Fuel Wasted | 12.35 |

*Period duration: 7.5 days

Improved voyage economics aggregate over time

Let us consider what would have happened if the operator did not have real-time visibility into the vessel’s actual performance. The vessel behavior likely would have continued, which could cause the ship to over-consume 29.71 MT worth of fuel over the course of a one-month voyage, and as much as 8,967.14 MT throughout its practical lifespan1. Even assuming a fuel price that is as low as it is today, that equates to millions of additional dollars in bunkers the vessel would have consumed based on this one operational anomaly alone.

Perhaps the cost burden for the fuel would be shifted to the counter-party depending on how the ship is chartered over time. Regardless, there is no good reason to needlessly burn ton after ton of HFO —for the owner or for the charterer— when such behavior is easily rectified by operational awareness and proper communication between the ship and shore. At the end of the day, the core misunderstanding of both the speed the vessel was running at and the amount of fuel it was consuming has even deeper commercial implications for the owner-operator.

Vessel efficiency drives commercial optimization

Every shipping company wants to price a vessel as optimally as possible, without exposing the business to the risk of a claim for underperformance. In the scenario above, the use of a poorly averaged speed with higher than necessary consumption produces a performance curve that lags the vessel’s actual efficiency. Leveraging the data from Nautilus Platform, this was obvious in plotting the vessel’s performance curve based on autologged data versus the performance curve based on the averaged speed and consumption from the noon reports.

| Speed (knots) | % difference between reported consumption and actual consumption |

|---|---|

| 15 | 1.1% |

| 16 | 1.2% |

| 17 | 1.2% |

| 18 | 1.2% |

| Avg. % difference | 1.2% |

Examining these two curves in the 15-18 knot range, there was an approximate 1% variance in vessel efficiency between the autologged and traditional noon data sources. Assuming an average TCE rate of $20,000 per day, this variance equates to a revenue increase of $200/day, $73,000 per one-year time charter, and $1.8 million over the practical life of the vessel. Because of both the increased operational visibility and real-time performance curves provided by Nautilus Platform, our client could drive higher day rates. And that is based solely on addressing the one anomaly Nautilus Platform identified on one voyage.

Maximizing profit with Nautilus Platform

Ultimately, minor variances add up. As a vessel is repeatedly thought to underperform its maximum output, this vicious circle sets a progressively lower bar, which forms the basis of every commercial agreement the company enters into—including whether to keep or sell the ship. Extrapolate that over not just one vessel, but over an entire fleet, and you have an asset and an organization that is chronically being held to a lower standard after every voyage.

| Timeframe (7.5 days) | Extrapolated 30 day Voyage | Extrapolated 1 Year Charter | Extrapolated 25 years | |

|---|---|---|---|---|

| Fuel Savings (Expense reduction) | $4,322 12.35 MT | $10,400 29.71 MT | $125,500 358.57 MT | $3,138,500 8,967.14 MT |

| Commercial Benefit (Revenue increase) | $1,500 | $6,000 | $73,000 | $1,800,000 |

| Total ROI Opportunity with Nautilus Platform | $5,822 | $16,400 | $198,500 | $4,938,500 |

In this case, our client was able to avoid that vicious circle and optimize commercial performance of their business by leveraging Nautilus Platform. This created the opportunity to improve operational fuel efficiency and develop a more accurate understanding of vessel performance, and ultimately for the ship to command a better rate in the market. Using data to eliminate fuel waste and improve vessel commercials is just scratching the surface of the value of Nautilus Platform.

1 This assumes average practical lifespan of a vessel is 25 years.